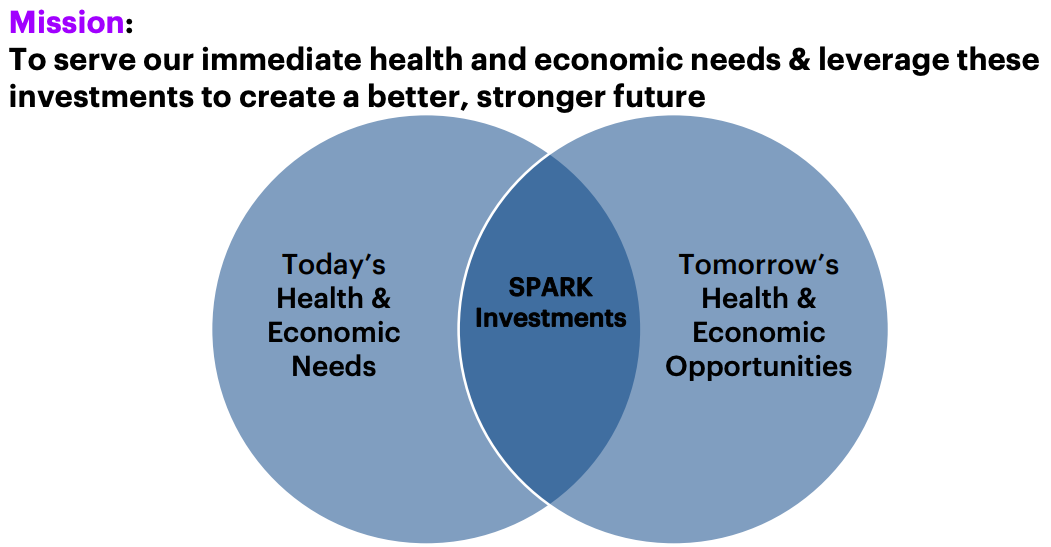

SPARK

Strengthening People and Revitalizing Kansas (SPARK) Montgomery County Round 1 Funding Programs

In June 2020, Governor Kelly appointed the SPARK taskforce to begin establishing funding opportunities to aid in responding to COVID-19 and the impacts that this pandemic has had on our economy, families, healthcare, schools, and communities. Kansas received $1.25 Billion in CARES Act Cornovirus Relief Funds, with $220 Million going to Johnson and Sedgwick Counties and $1.03 Billion to the remainder of the state. There will be 3 rounds of SPARK funding. Round one ($400 Million) was disbursed in July to all Kansas Counties based on population as well as economic and COVID-19 impact from COVID-19. Montgomery County received $6,527,793 in funding from this round.

In June 2020, Governor Kelly appointed the SPARK taskforce to begin establishing funding opportunities to aid in responding to COVID-19 and the impacts that this pandemic has had on our economy, families, healthcare, schools, and communities. Kansas received $1.25 Billion in CARES Act Cornovirus Relief Funds, with $220 Million going to Johnson and Sedgwick Counties and $1.03 Billion to the remainder of the state. There will be 3 rounds of SPARK funding. Round one ($400 Million) was disbursed in July to all Kansas Counties based on population as well as economic and COVID-19 impact from COVID-19. Montgomery County received $6,527,793 in funding from this round.

These funds are strictly to be used for certain expenditures:

- Necessary Public Health (COVID-19) emergency expenses

- Eligible expenditures not accounted for in the budget approved as of March 27, 2020

- Eligible expenditures incurred from March 1 to December 30, 2020

The funds were divided into two types of funding - Reimbursments and Direct Aid. Reimbursements are for organizations that already had to spend unbudgeted funds due to COVID-19. The Direct Aid Plan allowed eligible organizations to create a plan that would best help their organization respond to COVID-19. Montgomery County has tentatively defined 5 categories for funding allocations.

- Health - $3.2 Million

- Education - $1 Million

- Connectivity - $1 Million

- Economic Development - $1 Million

- Administration - $327,793

The County approved Direct Aid and Reimbursement requests on August 14, 2020, but cannot provide those funds officially until the State of Kansas approves the programs proposed by the organizations and the County. We anticipate that this will happen on or around September 15. We will post those awards once this is official.

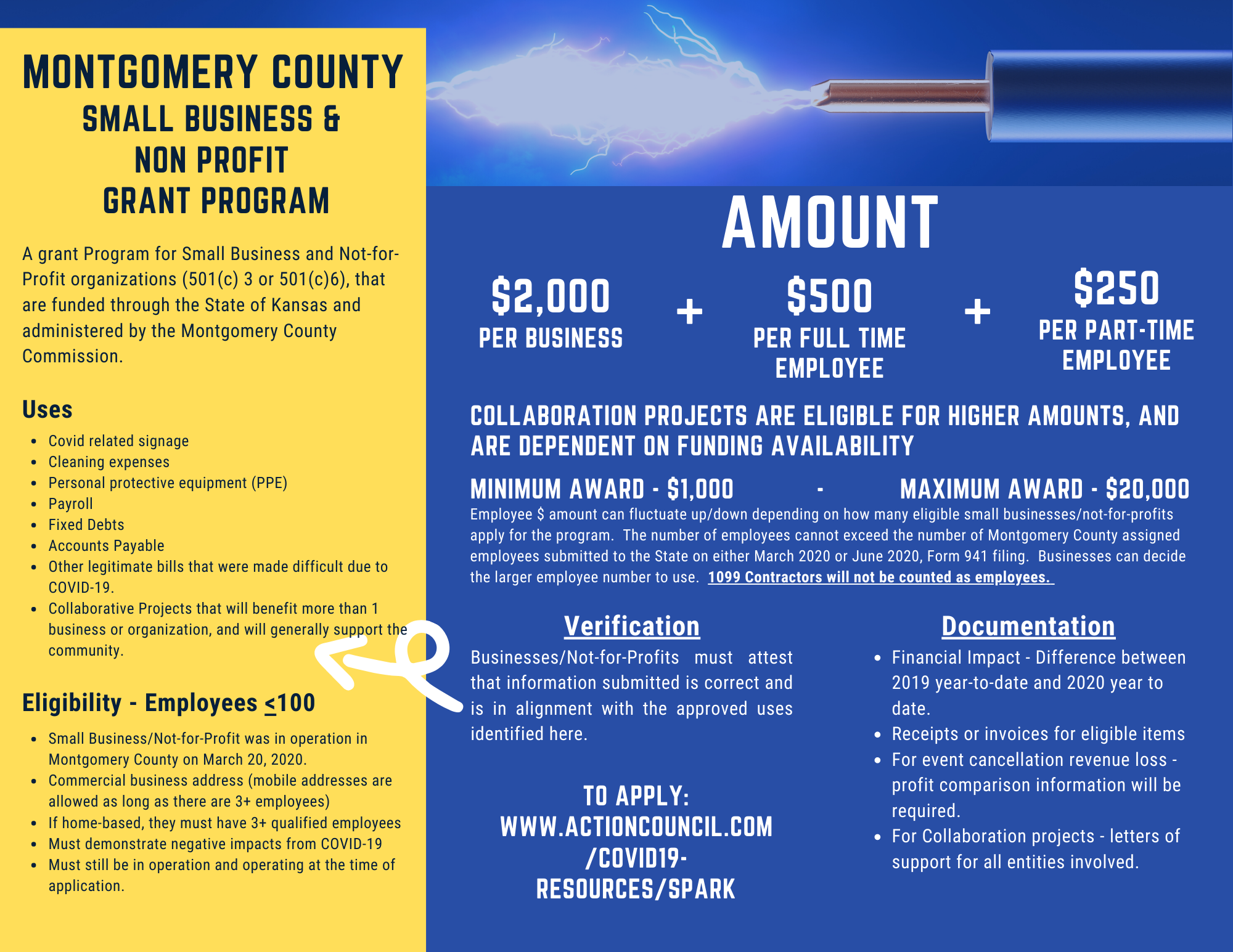

MONTGOMERY COUNTY SPARK GRANT FOR SMALL BUSINESSES AND NOT-FOR-PROFIT ORGANIZATIONS

PROGRAM OVERVIEW

MONTGOMERY COUNTY SPARK GRANT FOR SMALL BUSINESSES AND NOT-FOR-PROFIT ORGANIZATIONS

Out of the $1Million allocated to Economic Development in the plan above, the County designated $400,000 for Small Business and not-for-profit organizations, with a cap set at $100,000 for not-for-profit businesses. Businesses and non-profit organizations will have to show that they have a need for the funding due to the impacts of COVID-19. They can do this by providing information on the following:

- Revenue loss

- Revenues lost and not recouped due to event cancellations, business closures, or loss of sales, etc. due to COVID-19. Businesses/Not-for-Profits will have to provide 2019 revenues and compare those to current revenues. If an event will be cancelled in the fall/winter of 2020 due to covid, those are eligible, but additional information will need to be provided to justifiy why there isn't a difference yet from 2019 - 2020. New businesses are eligible as long as they were open by March 20, 2020, and can demonstrate using a business plan or financial plan expected revenue prior to March 1, 2020.

- PPE / Covid-19 Prevention/Sanitation Expenses

- Expenses for PPE, Cleaning and sanitation, signs or information provided to customers/clients/etc. Organization will have to certify and provide receipts that they have not already been reimbursed for these expenses through another program.

- Collaboration

- Programs that will help multiple businesses/not-for-profits by collaborating together to provide an innovative resource that will help the community and all organizations recover from COVID-19.

ELIGIBILITY

- Businesses with less than 100 employees

- Not-for-Profits with less than 50 employees (including national)

- Not-for-profits that are a 501(c)3 or a 501(c)6

- Small Business/Not-for-Profit was in operation in Montgomery County on March 20, 2020.

- Commercial business address (mobile addresses are allowed as long as there are 3+ employees)

- If home-based, they must have 3+ qualified employees

- Must demonstrate negative impacts from COVID-19

- Must still be in operation and operating at the time of application.

- Will have to have a DUNS NUMBER! You can get this number here: https://fedgov.dnb.com/webform/

AWARD AMOUNTS

- $2,000/Business/Not-for-profit + $500/Full Time Employee + $250/PT Employee

- Collaboration projects are eligible for up to $20,000.

- Minimum award of $1,000 if all eligibility requirements are met.

ELIGIBLE EXPENSES

- Working capital such as wages, utilities, rent, etc.

- COVID-19 related signage

- Cleaning/Sanitation expenses

- Personal Protective Equipment (PPE)

- Payroll

- Fixed Debts

- Accounts Payable

- Other legitimate bills that were made difficult due to COVID-19.

- The purchase of 60 days’ worth of inventory needed to reopen (60 days will begin on the day the business is allowed to reopen).

Invoices and receipts must be submitted prior to funding being disbursed.

APPLICATIONS ARE OPEN!

Appliations will be accepted on a first-come-first-served basis. Tip: Get your FEDERAL DUNS NUMBER TODAY!!! YOU CAN GET THIS HERE:

Step 2 - Supporting Documentation

CONFIDENTIALLY EMAIL ANY SUPPLEMENTARY INFORMATION IN PDF FORMAT TO: spark@actioncouncil.com

APPLICATIONS RECEIVED WITHOUT SUPPORTING DOCUMENTATION BY OCTOBER 1, 2020 WILL NOT BE ELIGIBLE FOR FUNDING!