Montgomery County is a Rural Opportunity Zone Participant

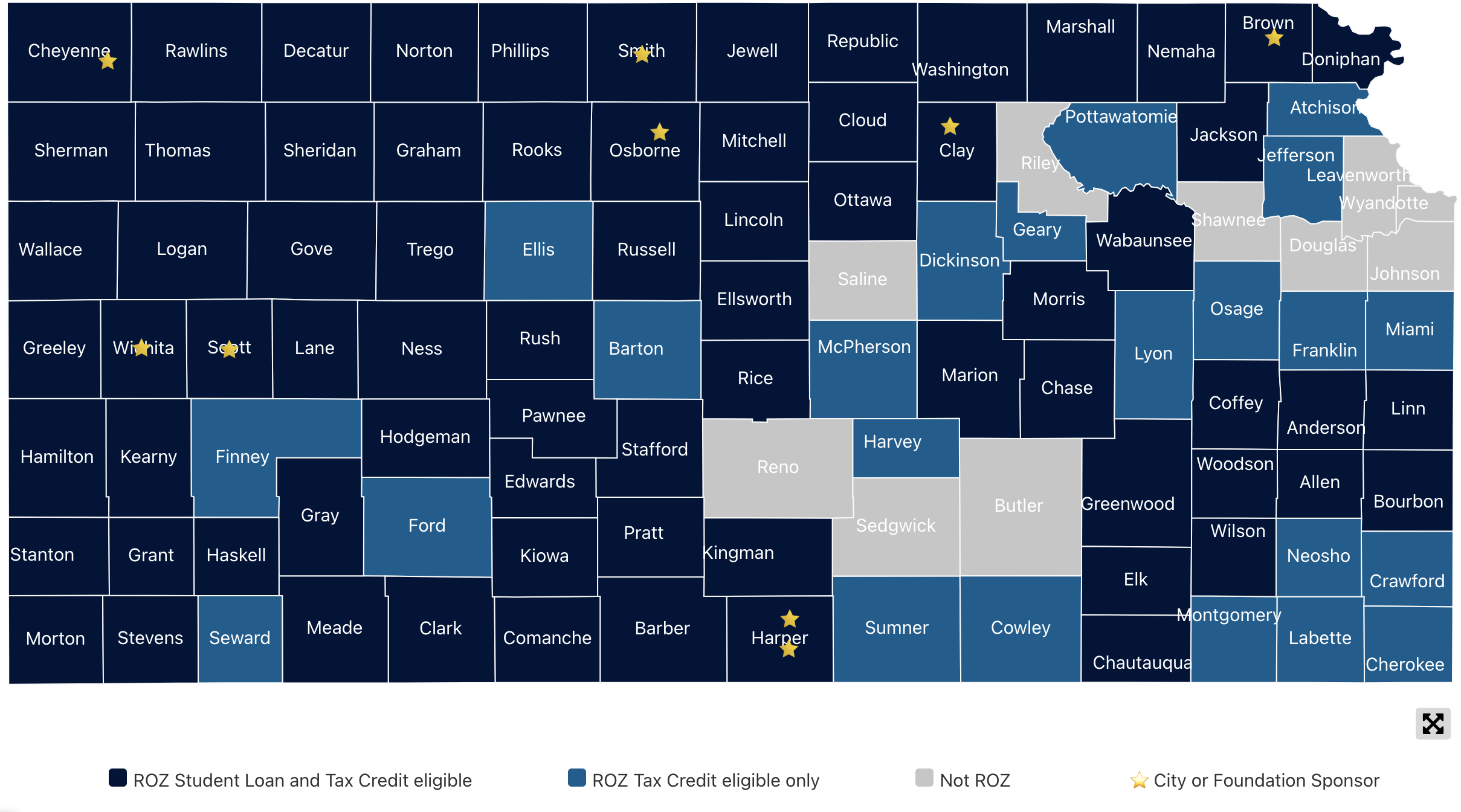

Rural Opportunity Zones (ROZ) are designed to spur economic development in and expand job growth in 95 counties around the state.

The program provides employees with up to a 5-year personal income tax credit on their state income taxes!

Rural Opportunity Zone Benefits

There's something special about life in rural Kansas. Something authentic, something that makes it the ideal place to live, to work, and raise a family. Thanks to the Rural Opportunity Zone Program, there's no better time than now to make rural Kansas your home!

If you are looking for a lower cost of living & a better quality of life; Kansas is your best choice! Rural Opportunity Zones are 95 counties that have been authorized to offer the following financial incentive:

- 100% State Income Tax Credit: Waives your state income tax for 5 years when you move to Kansas from another state.

Who's Eligible?

100% State Income Tax Credit:

- Lived outside of Kansas for five or more years immediately prior to moving to Montgomery County

- Earned less than $10,000 in Kansas source income in the 5 years prior to moving to Montgomery County

- Moved to Montgomery County on or after July 1, 2014

For general inquiries about the Rural Opportunity Zone program, please contact KDC_ROZ@ks.gov.

ROZ Overview

Montgomery County was identified as a ROZ county in 2014. ROZs have been authorized to offer financial incentives to new full-time residents. New residents can receive an Income Tax exemption for 5 years if they relocate from out of state.

100% Income Tax Credit

A state income tax exemption for up to five years to individuals who move to a ROZ county from outside the state. Individuals must not have lived in Kansas for the past five years, nor have Kansas source income of more than $10,000 per year over the past five years..