Montgomery County Action Council (MCAC) is the economic development agency for Montgomery County, Kansas. Our organization works collaboratively with local and regional partners to attract new business investment, encourage the expansion of existing industry and small businesses, align workforce education and training with in-demand jobs, locate new markets for Montgomery County products, and plan and mobilize resources for economic development.

The purposes of Montgomery County Action Council (MCAC) include serving as a leader and innovator of economic development programs and as a unifying element among Montgomery County communities by developing and maintaining an economic climate which creates jobs, increases the tax base, promotes economic diversity, and enhances the quality of life for all citizens of Montgomery County.

#1

Most Business Investment

Per Capita

Site Selection Magazine

#1

GDP Growth in the Nation Q3 2023

Bureau of Economic Analysis

#1

Highest Ratio of Energy Generated by Wind

U.S. Department of Energy

Every business across Montgomery County has its own reasons for joining MCAC, which means they benefit in different ways. However, there are a few common draws that reflect the value that MCAC provides. Here’s why you should join:

MCAC actively promotes its members to customers and the local business community throughout the year.

Members can enjoy business resources and support. Very few business owners are experts in everything.

Your membership fosters business growth.

Your involvement can reach the state and federal governments.

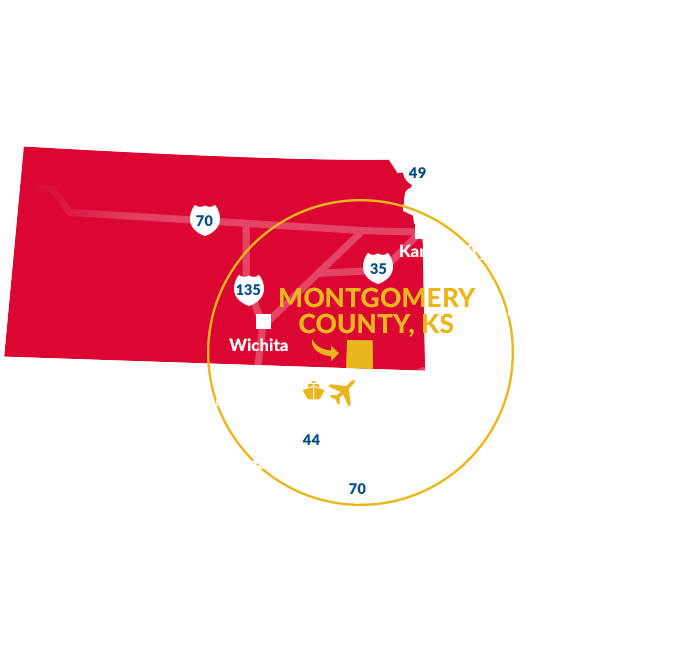

Looking to relocate or start your business in the Midwest? Businesses big and small can find the ideal location to site and grow their businesses in Montgomery County, Kansas.

200 N. Galveston • Cherryvale, KS 67335

Suited for several types of use, warehouse, manufacturing, storage or start up business. Learn More

317 N. Pennsylvania Avenue • Independence, KS 67301

This is an available building in downtown Independence . Learn More

5184 Industrial Street • Coffeyville, KS 67337

This facility benefits from being located in a dense Industrial Park. Learn More